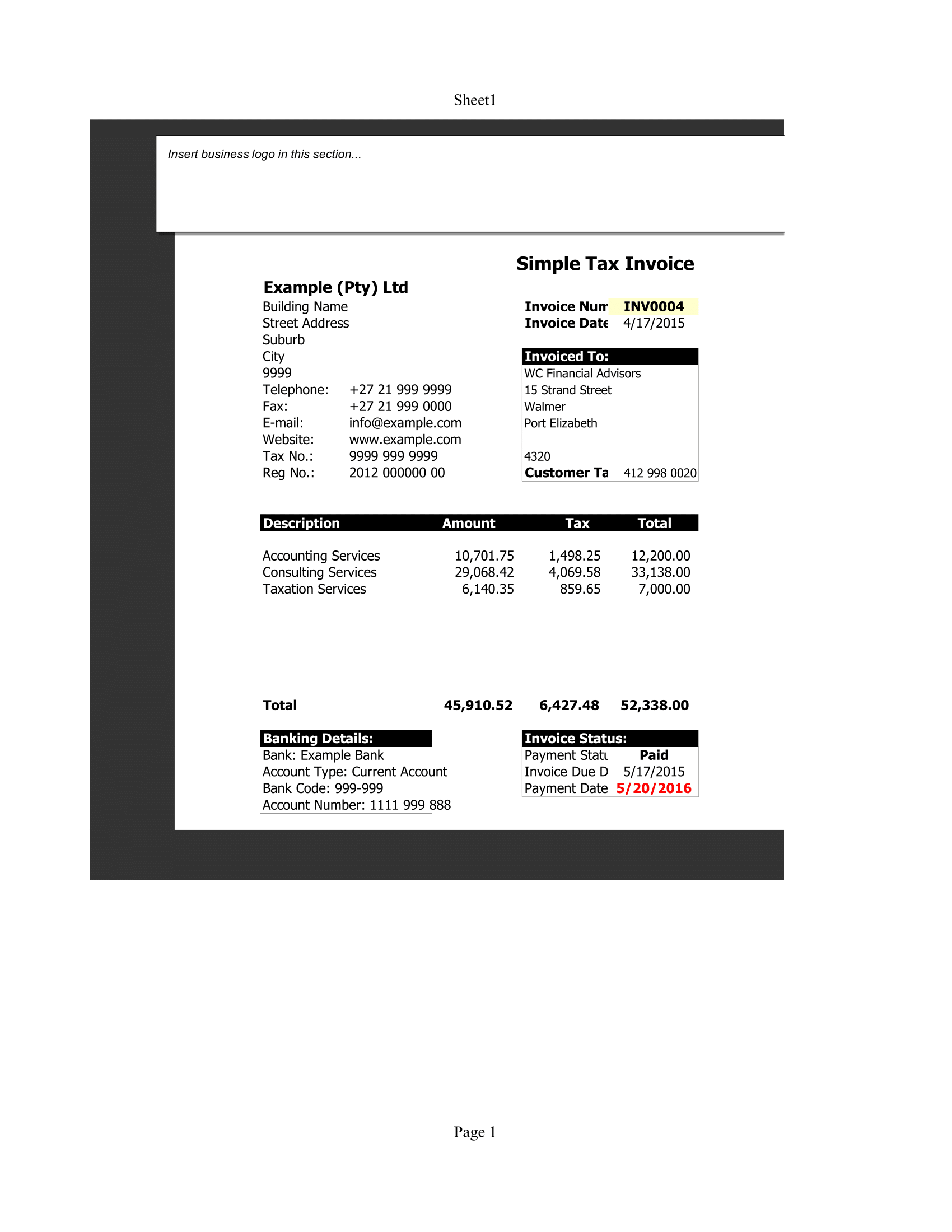

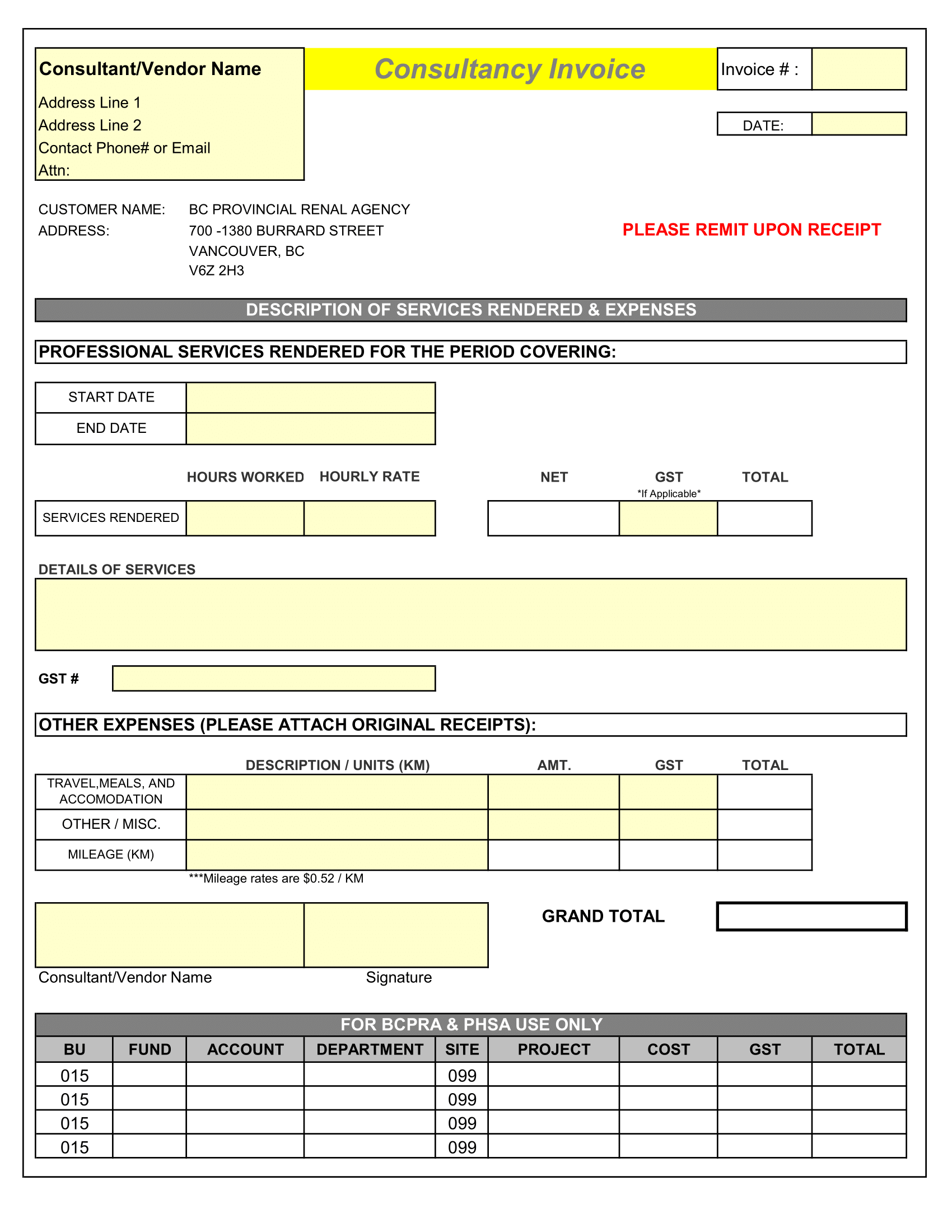

There is a tax implication whenever there is supply of goods or services or both. However, this is dependent in the demography and place of supply. For example, UAE has VAT and India has GST. Now, this template is an invoice template for raising tax invoices.

You can capture the following information with the help of this excel template:

- Name of your company, address and other information

- Registration (Tax) number of your company

- Invoice to – customer name and information

- Invoice number and date

- Description of service

- Amount of service (pre-tax)

- Tax amount

- Total of service value and tax amount

- Banking details

- Invoice status (payment status, invoice due date and payment date)

Since, this invoice template is fully customizable – you can add, remove or customize fields to create your own personalized excel template. You can add tax rate field to bring in transparency. Tax invoices are essential in a registered business to file for tax returns and reconciliation. This tax invoice template will help in some manner. You can also explore business invoice template.

Tax invoices help in collecting outward supply tax amount. Tax reconciliation is important to claim tax credits. Tax invoices ensure that outward supply is adequately taxed. You can stay tax compliant with the help of invoices.