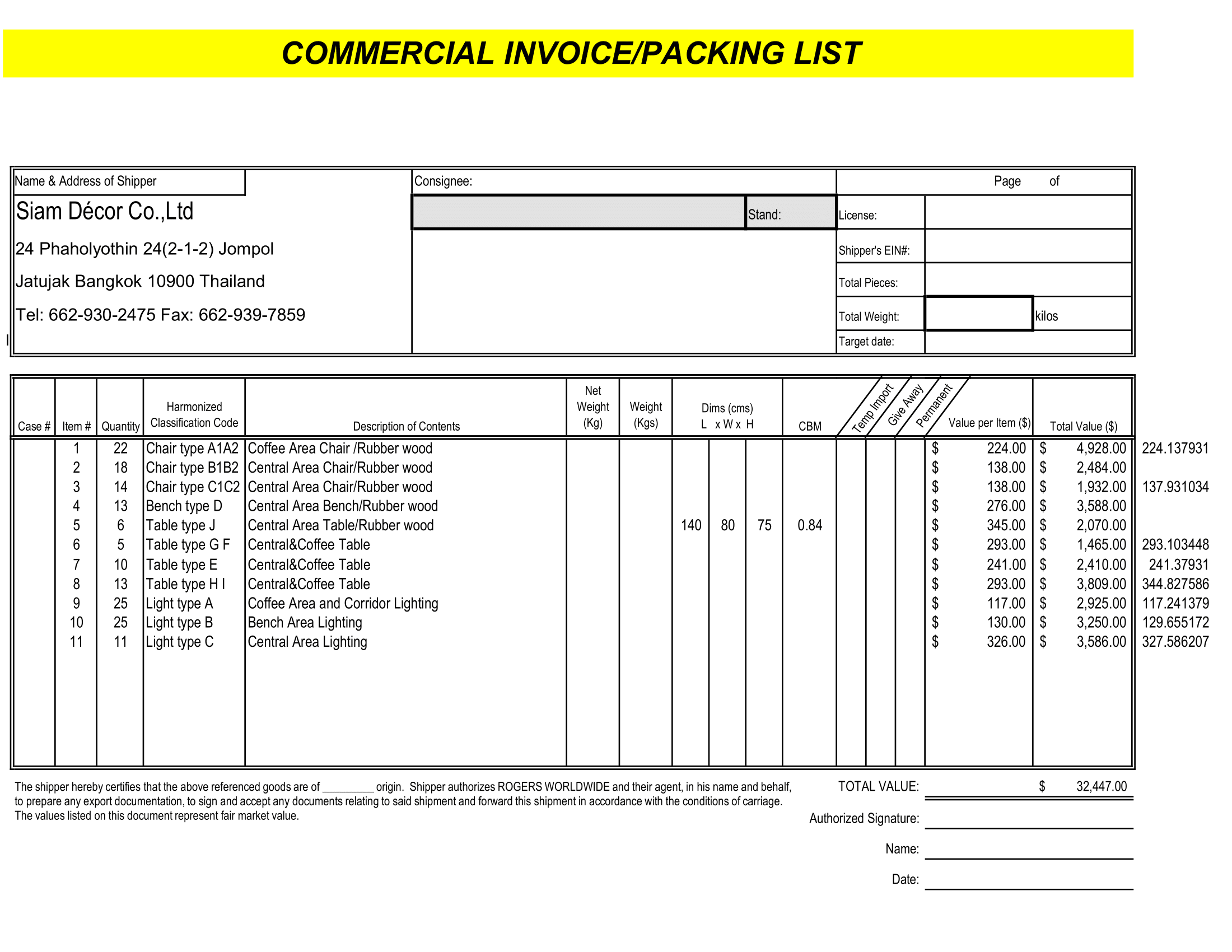

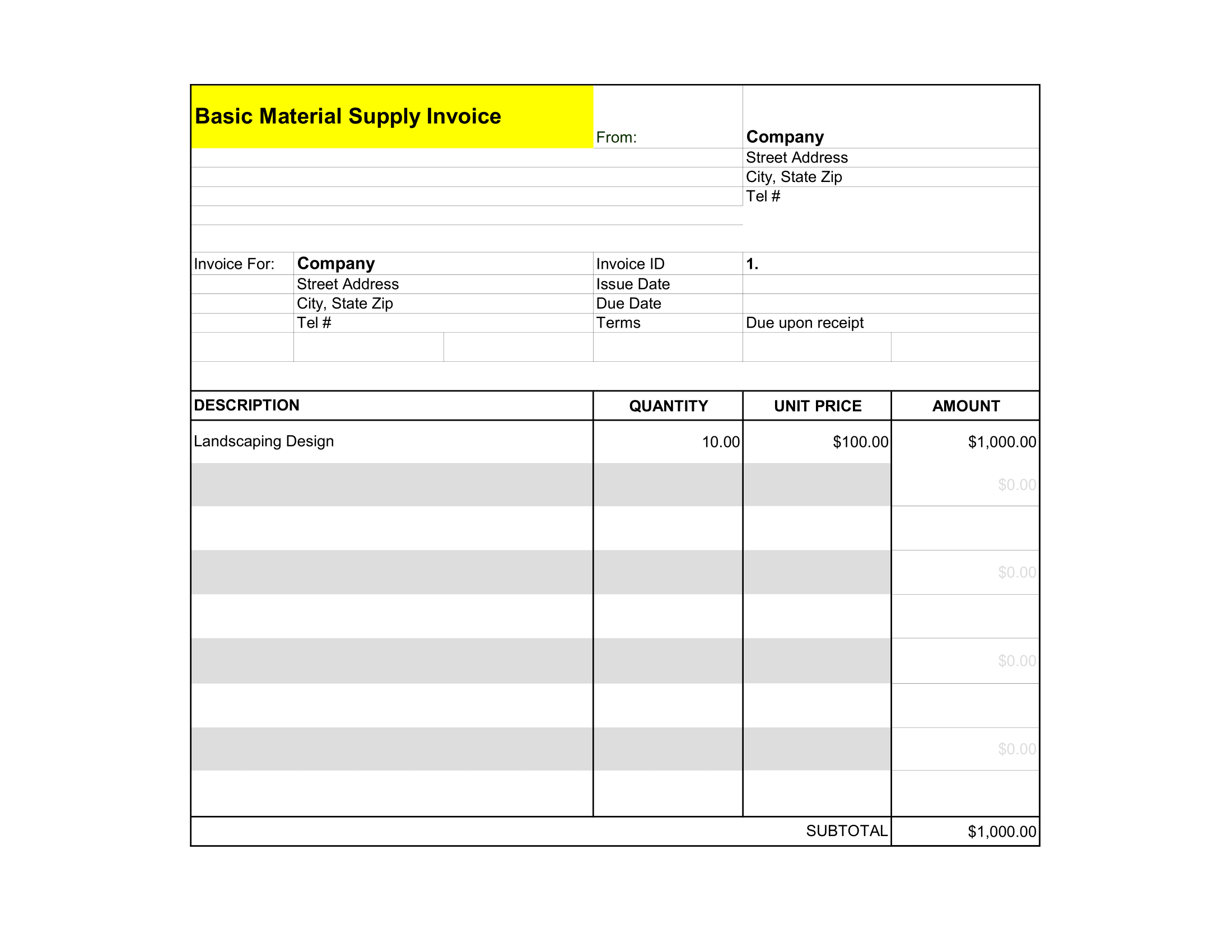

Business Invoice include tax portion on the supply of services and goods. Tax rates and tax nomenclature might vary based on the place of supply and legal compliances. For example, in India – Goods and Service Tax (GST) is applicable. In United Arab Emirates (UAE), Value added tax (VAT) is applicable.

This invoice template comes with Field to compute tax so that you can invoice full amount (including tax) to your client. Apart from tax computation, this invoice template helps you capture the following information as well:

- Company information, logo and address

- Name and address of your client

- Date of invoice

- Invoice number

- Terms and Condition or any other Footer Note

- Rate of tax applicable.

- Total value of service or goods (including tax)

You can customize this template as per your requirement and preferences. This is available in Excel format. However, it is compatible with Numbers, Google Sheets and Spreadsheet software.