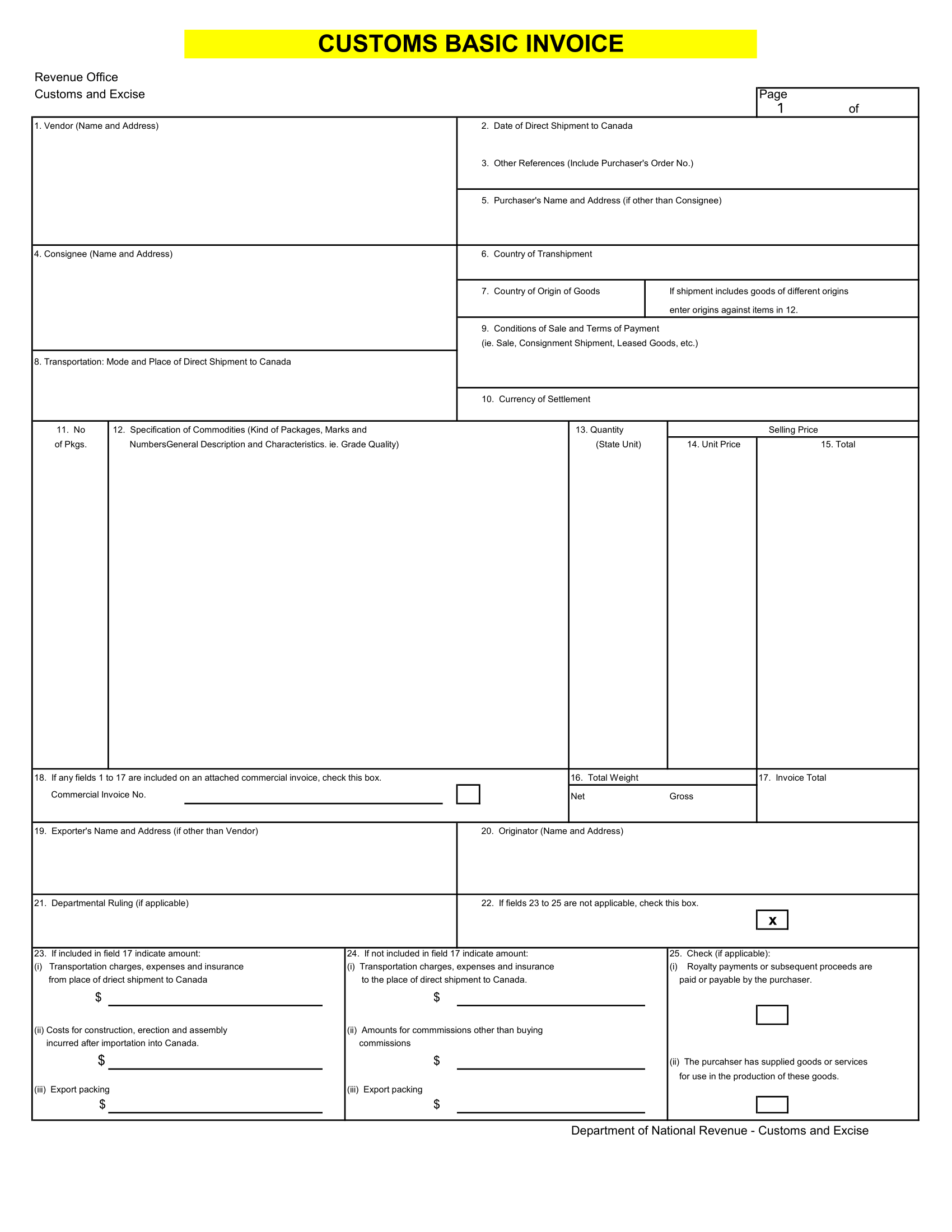

Whenever you are exporting any material to foreign land, the materials will have to go through customs. Now, A customs invoice is an approximate bill of sale. They are used for high value orders and act as a finalizing document. Commercial invoices, on the other hand, are used by smaller merchants that sell to customers because the seller has already received the payment. Foreign buyers require this document in order to prove ownership and arrange for payment.

You’ll need the number and date of related paperwork. This might be a proforma invoice, purchase order or sales contract. Then you’ll need to include details of unit price, method of payment, currency, and any discounts. Next, you’ll be required to include details on weight and the number of goods being delivered. Exporter’s number, SIC Code or HSN code of materials and other related information should be adequately reflected in the invoice as well.

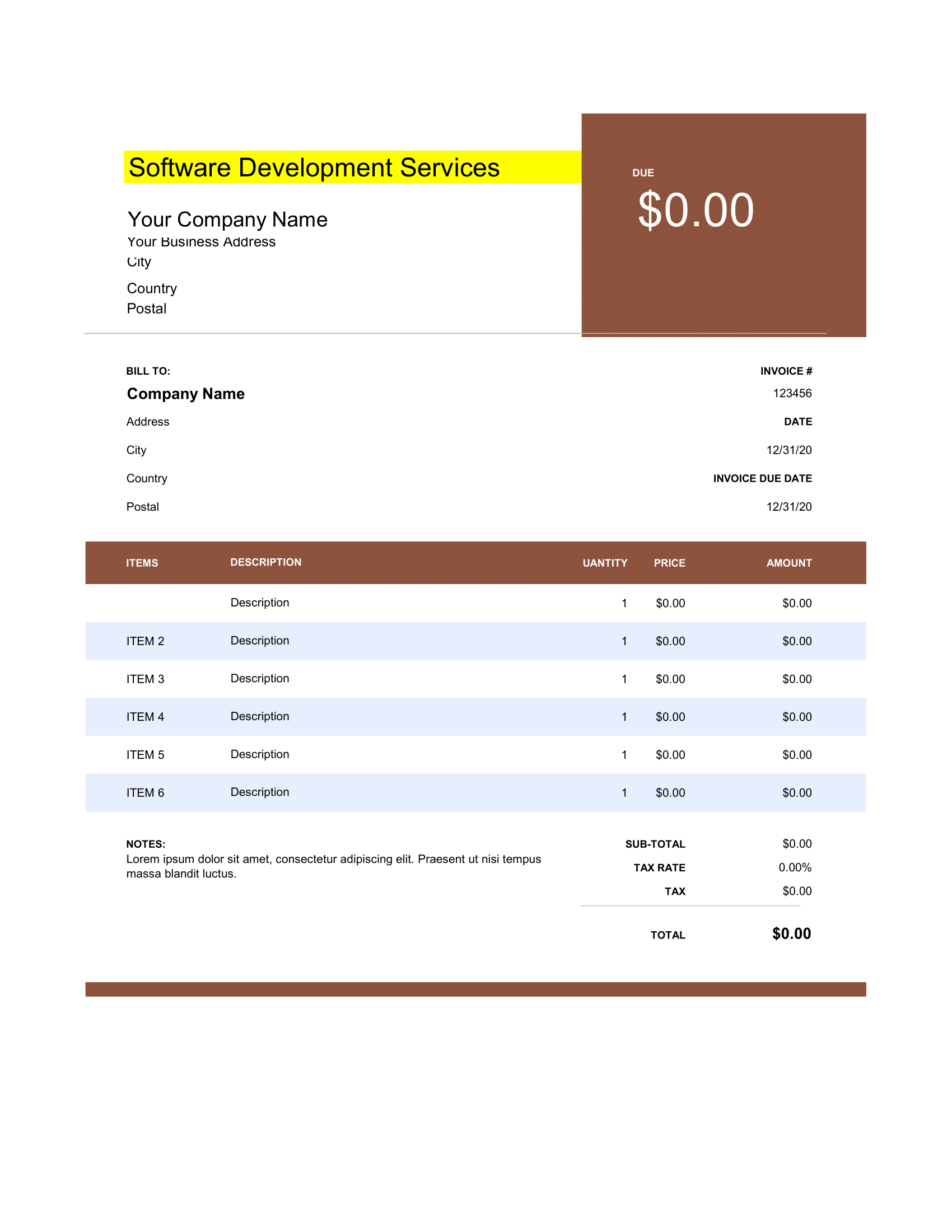

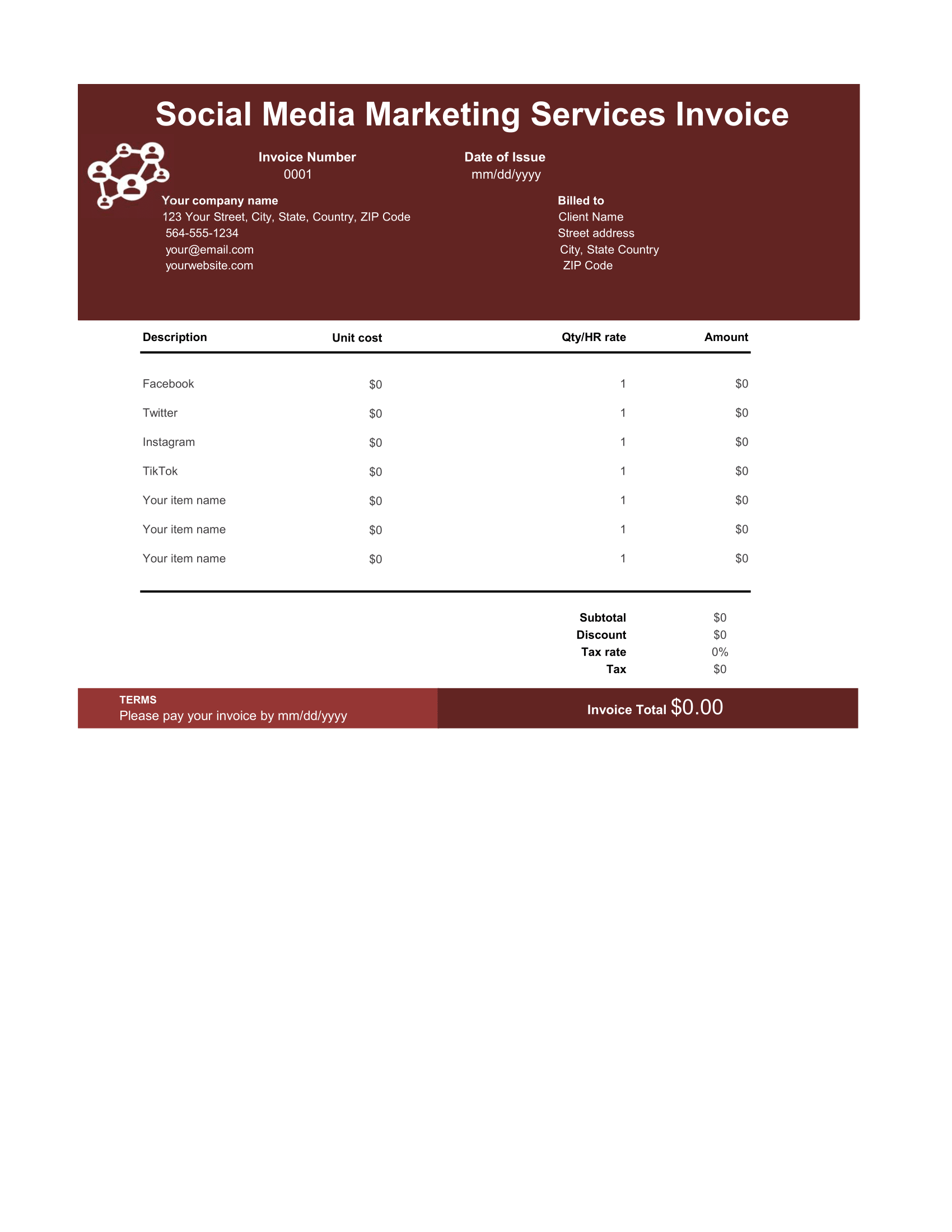

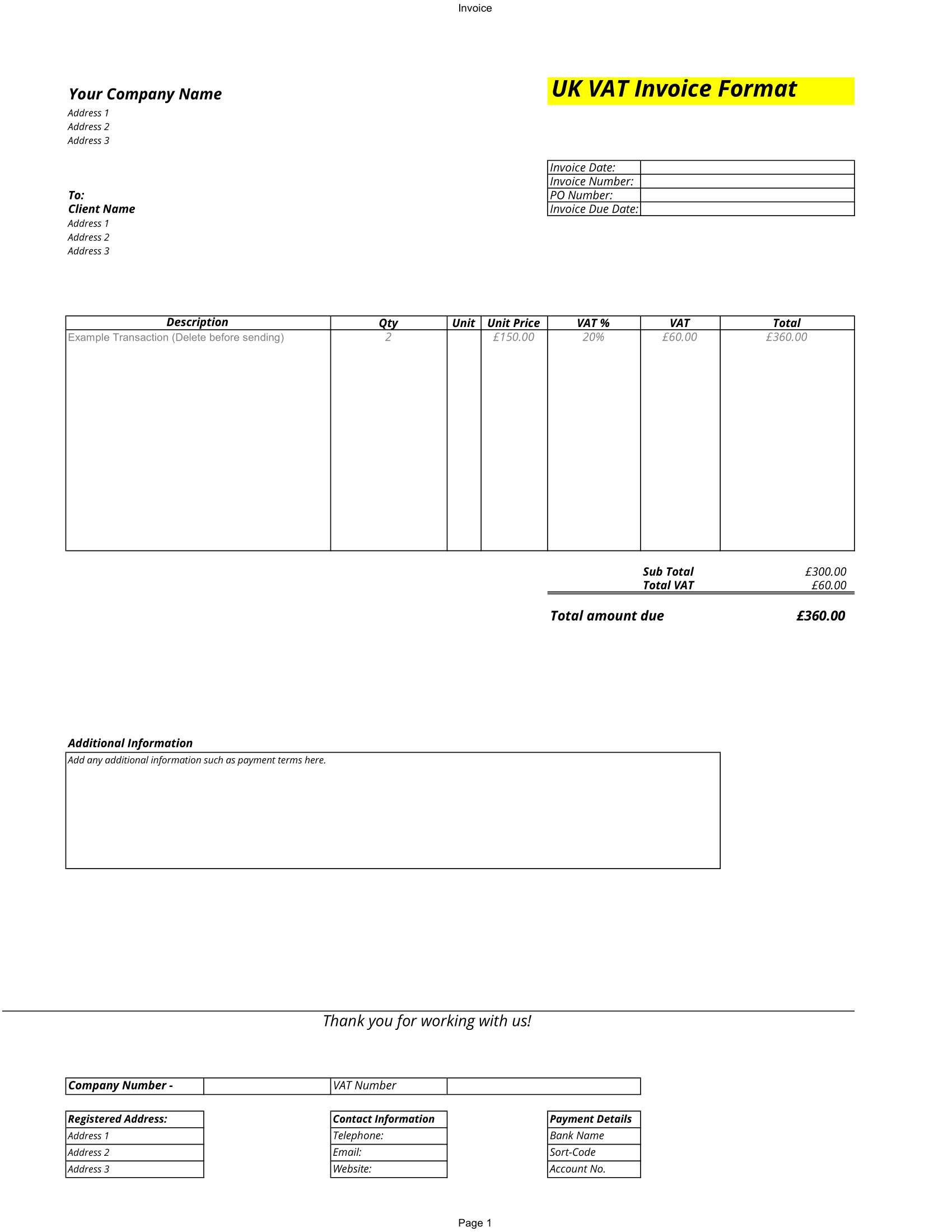

This excel template gives a initial fields and idea on how customs invoice will look like. With consultation from expert, you can modify this template to curate a standard template for your business or business of your client. Also explore commercial invoice with packing list which might be something that will give you additional information and ideas.